My Store

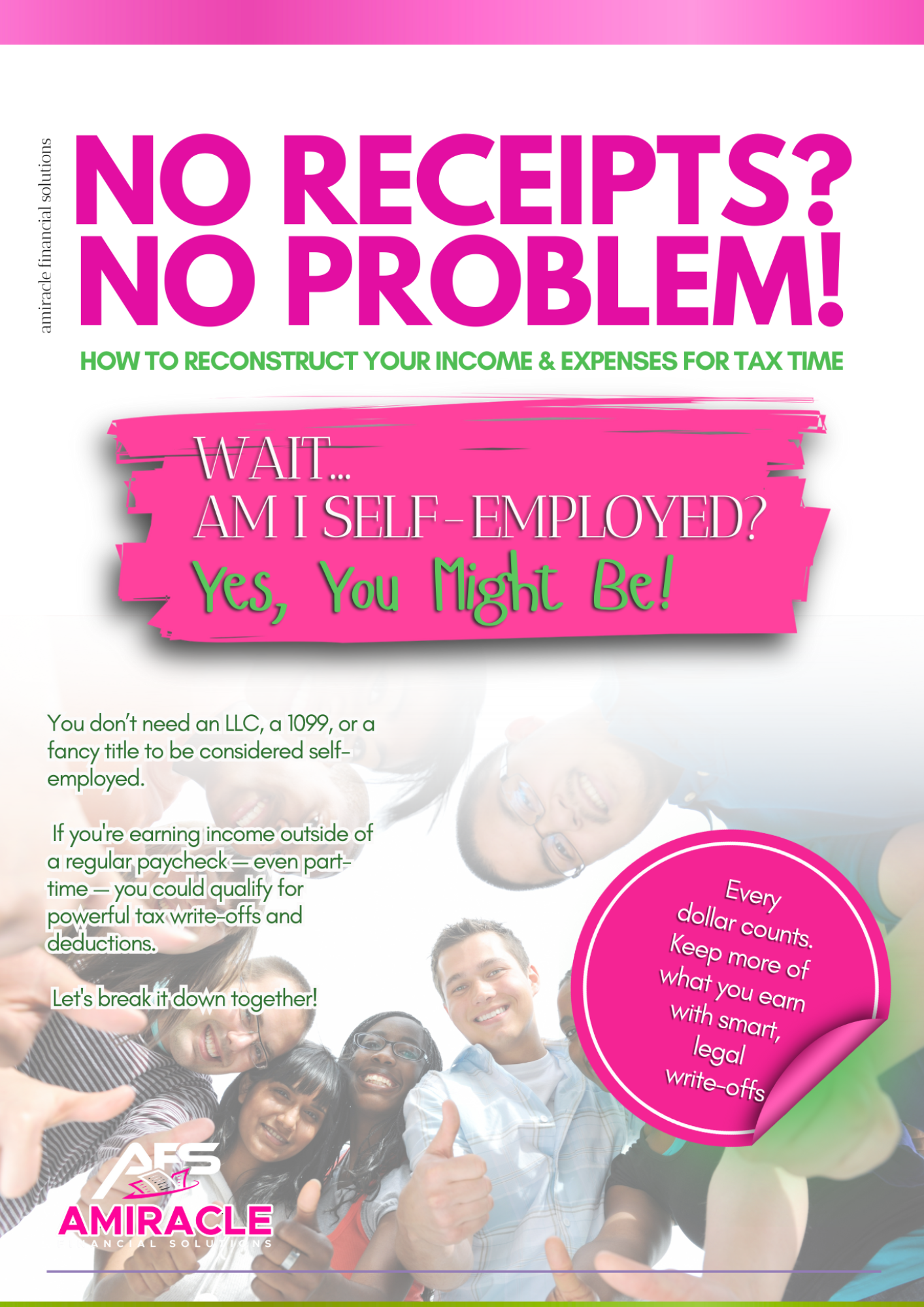

No Receipts? No Problem!

No Receipts? No Problem!

Couldn't load pickup availability

📘 No Receipts? No Problem!

How to Reconstruct Your Income & Expenses for Tax Time

Think you can’t claim tax deductions because you don’t have an LLC or receipts? Think again.

“No Receipts? No Problem!” is your step-by-step guide to reconstructing your income and expenses for tax time — even if you’re just starting out, paid in cash, or side hustling without a formal business.

✅ Perfect for:

-

Hairstylists 💇🏽♀️

-

Nail techs 💅🏽

-

Babysitters 👶🏽

-

Food vendors 🍗

-

Creatives, freelancers, & gig workers 💻

-

Anyone paid outside of a W-2!

📘 Inside, you’ll learn:

-

How to legally count your income — even without receipts

-

What the IRS really looks for

-

Easy ways to track cash or app payments

-

Common write-offs you might be missing

-

How to prove you’re self-employed and qualify for deductions

⚡ Stop leaving money on the table.

You earned it — now let’s help you keep more of it.

Download your copy today and start saving smart!

This is a digital download.

Share